ACH and eCheck are known as the most basic forms of electronic transacting and have paved the way for more advanced methods of processing money. Although both are reliable and relatively faster to move funds than paper checks, credit card processing remains the most favorable method for the majority of American merchants.

But what about the high-risk merchants who are unable to obtain a credit card processing account?

Certain industries pose financial risks to banks due to greater chances of businesses inducing chargebacks to their accounts. Additionally, individual companies will most likely be considered risky if they already have an adverse chargeback history. You can read more about high-risk merchants, or you can contact us at Revitpay to find out where your business stands in terms of risk.

ACH and eCheck processing are great alternative forms of sending and receiving money for merchants who are high-risk, sell high-ticket products or services, or for those who wish to offer their clients additional payment methods. ACH and eChecks fare better for some merchants, while credit card processing is the optimal choice for others.

eCheck is a form of ACH processing and operates like a standard ACH transaction but with distinct differences. It would be false to use the two terms interchangeably. Differentiation in product prices, fees, and industries separate eChecks and ACH from being the same thing.

As an e-commerce merchant, you may be satisfied with solely accepting credit cards. However, upon learning more about ACH and eChecks, you may be surprised at how these traditional forms of electronic transacting could benefit your high-risk business.

What is the Difference Between ACH and eCheck Processing?

First, What Exactly are They?

ACH processing stands for Automated Clearing House. Funds are electronically processed from one bank to another through the ACH system. After a customer initiates a transaction, a digital check is formed to be processed but never printed out.

ACH is known to be used for debit transfers such as direct deposit, but it is also used as a form of payment for products or services, transferring money from a client’s issuing bank to the merchant’s acquiring bank.

NACHA, the National Automated Clearinghouse Association, regulate ACH transactions within a network of American financial institutions.

eCheck processing stands for electronic check. It goes through the ACH system and also develops as a digital check. However, the merchant’s eCheck processor will physically print out the check and run it through a scanner. It takes less time to process than a true physical check, which can have long hold times.

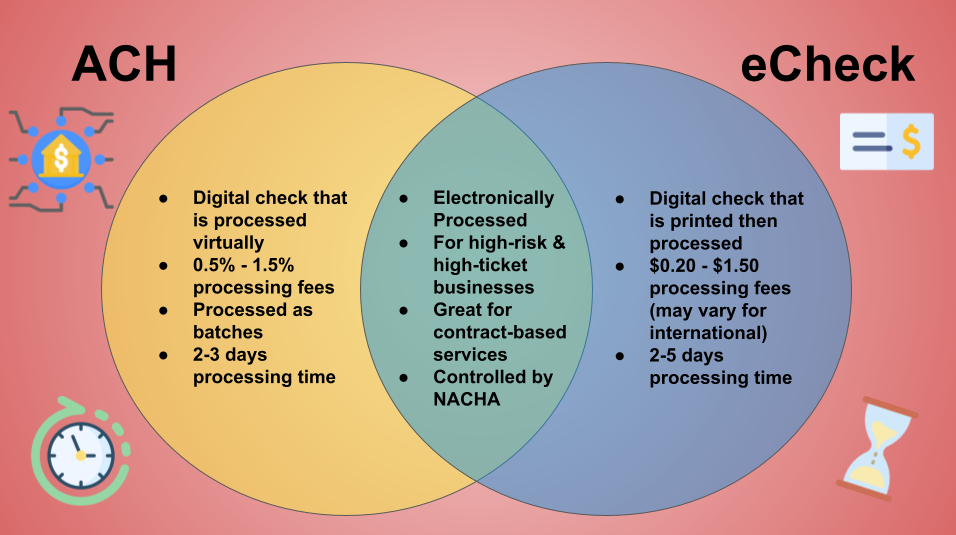

Here is a simplified diagram of how ACH and eCheck processing compare to each other.

Keep this in mind as we continue to talk about which processing methods will work best for your e-commerce business.

Why Merchants Consider Alternatives to Credit Card Processing

High-Risk Barriers

As mentioned previously, there are high-risk merchants that credit card processors and banks are unwilling to work with. Industries that are more likely to receive chargebacks or are more susceptible to fraud can look to process in other ways, like through ACH or eChecks.

Rather than fulfilling a transaction with a card, bank account information is inputted by the customer, which is then processed through the ACH system.

High-Ticket Items

High-ticket items are products and services that are individually more expensive than an average consumer purchase and usually cost at least $2,000. These can be furniture, cars, or anything of high value.

Some clients may be uncomfortable using a credit card for a $2,000 purchase. If you sell high-ticket products, having ACH or eCheck processing will give your customers more ways to fulfill a transaction.

ACH and eCheck processing take longer than credit card processing, but only by a few business days. It works well for companies that don’t immediately need the funds to provide a service or send over a product.

Subscription and Recurring-Based Businesses

Monthly and yearly subscription services are on the rise throughout a multitude of industries.

Within the last handful of years, companies have relied on recurring-based business models for a good chunk of their revenue, with some who claim that 40% of their revenue stems from subscriptions.

Clients may want an option to have their recurring-based purchases paid from their checking accounts, so they don’t have to be concerned about when a recurring charge hits their credit card. Cards can become locked or declined more easily than checking accounts. Using ACH to pull funds from accounts can guarantee payment fulfillment, while a blocked card can prevent merchants from receiving payments on time.

An ACH option for subscriptions will also be more reliable than credit cards, which are more likely to be declined or locked.

More Options, Less Cart Abandonment

Cart abandonment refers to clients adding items to their cart with the intention of purchasing but then don’t follow through with doing so. There is a multitude of reasons why clients may abandon their carts at checkout.

Students, young consumers, or those with a preference for paper checks may not own credit cards. By offering additional payment methods, you open your business up to anyone with an active bank account.

Additionally, with the rise of fraud, credit cards can become locked, rendering them useless. They also get lost, expire, or decline. For a person in a situation where they do not have a card available and don’t have time to get one, still purchasing an item is an option that you can give them by implementing ACH or eCheck processing.

ACH, eChecks, Credit Cards: Which is Right for My Business?

Each of these processing methods caters well to specific businesses. Many companies even utilize all three to give customers options.

Here are comparisons between processing with credit cards, ACH, and eChecks, including which merchants each processing method is best for.

Credit card processing

Pros:

- Fast processing

- Strong tools available for merchants fighting disputes

- The majority of consumers pay via credit card

Cons:

- Higher fees than ACH & Check processing

- Fees vary depending on the type of credit card

- More susceptible to fraud and chargebacks

- Can be canceled and declined easily

- Difficult for many high risk merchants to obtain a credit card merchant processing account

Best for:

- Merchants with items and services that cost less than $1,000

- Merchants who need funds right away to ship out ordered products

- eCommerce industries such as clothing, cooking ware, books, and the like

ACH

Pros:

- Processing is available for most high risk merchants

- Lower processing fees than credit cards (0.5%-1.5% per payment)

- Faster processing than eChecks

- Less susceptible to fraud

Cons:

- Usually slower than credit card processing (2-3 days)

- Requires bank account information from customers to be processed, which most people don’t carry with them

- Disputes are harder to challenge than credit cards

- Banks are usually not willing to set up ACH receiving for merchant accounts

Best for:

- High risk merchants

- Businesses with high-ticket items and services that are at least $1,000-$2,000

- Businesses that offer contract-based services

echecks

Pros:

- Available to high risk merchants unable to obtain credit card or ACH processing accounts

- Lower processing rates than credit cards and ACH

- Less susceptible to fraud

Cons:

- Slow processing (2-5 days)

- Requires bank account information from customers to be processed, which most people don’t carry with them

- Disputes are harder to challenge than credit cards

- Banks are usually not willing to set up eCheck/ACH receiving for merchant accounts

Best for:

- High risk merchants

- Businesses with high-ticket items and services that are at least $1,000-$2,000

- Businesses that offer contract-based services

Conclusion

We understand how challenging it can be for high-risk merchants to obtain processing accounts from banks and financial institutions. With us, we don’t judge you by the risk that you portray through your industry or history. Our ability to open up processing accounts for high-risk merchants reflects our superior service.

At Revitpay, we provide options so that you can offer your clients more. Our experts can help you determine if either credit card, ACH, or eChecks processing is the most optimal choice for your store.

Have a question about merchant accounts? Want to know which kind of processing is right for you? Contact us here for a personalized merchant service experience with Revitpay.